Last Updated: April 1, 2025

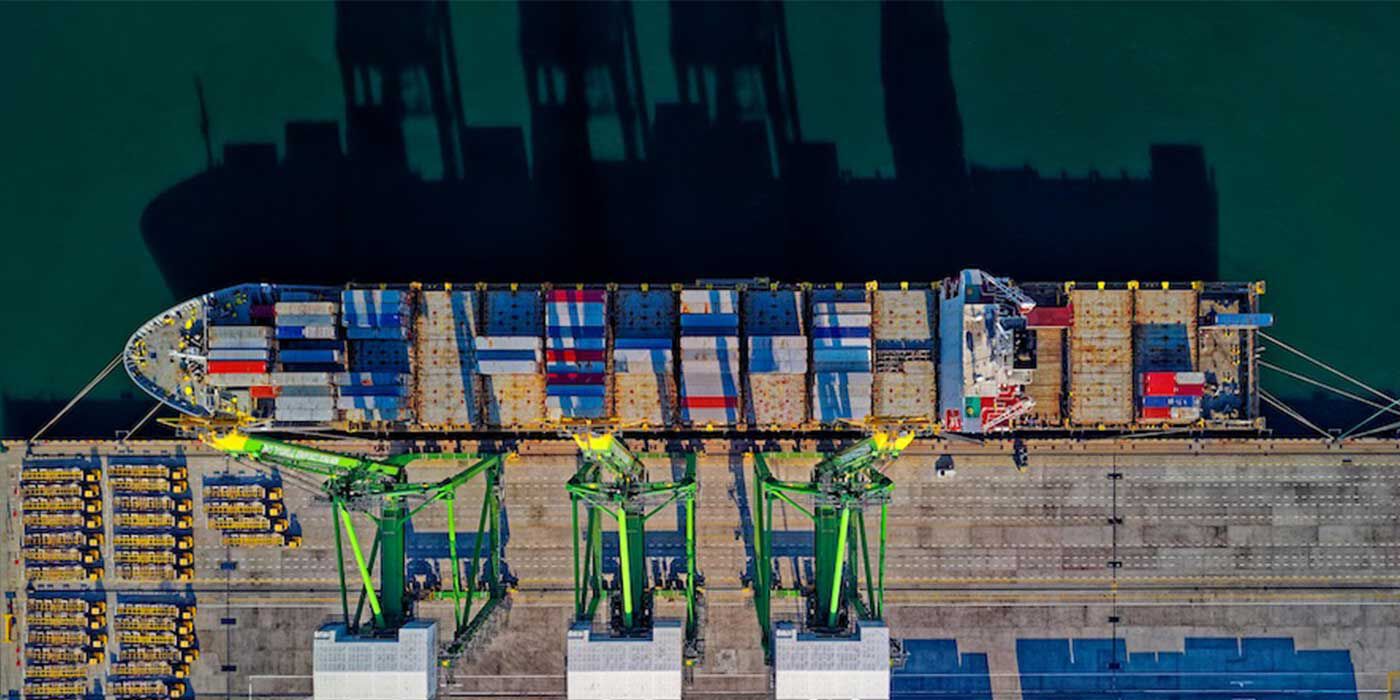

Tariffs are a key part of international trade policy, influencing the prices of goods and services that consumers and businesses pay. In this article, we’ll explain what tariffs are and how they might affect your purchases, so you can make more informed buying decisions.

What is a Tariff & How is It Different from a Tax?

Tariffs are different than other taxes, like sales, income, and property taxes. They directly affect the price of imported goods, leading to higher consumer prices.

A tariff is a levy or duty that the government imposes on imported goods. When a product crosses a country’s border, the government charges a fee before the product can enter the U.S. economy. It’s essentially a type of tax on imported goods when they are brought into the US from abroad.

Current U.S. Tariffs

In March 2025, The United States imposed a 25% tariff on all steel and aluminum imports. This measure aims to bolster domestic production of these metals.

Will Tariffs Impact My Fire Feature Purchase?

The situation with tariffs is very fluid, changing every day. For now, the short answer is: your purchase might be affected, but it depends.

The most immediate and direct effect of the tariffs is the increased cost of raw materials. Steel and aluminum are critical in manufacturing certain components needed to build fire features.

With rising material costs, manufacturers could experience higher production expenses. As a result, some companies may need to raise the prices on their products.

Impact on the Fire Industry

The tariffs affect several sectors of the economy, and the fire industry is no exception as it relies heavily on imported materials that are not easily or affordably produced in the US.

More Expensive Materials

The 25% tariffs on aluminum and steel imports will raise the cost of essential materials, leading to higher production expenses.

Canada is the largest foreign supplier of steel and aluminum to the United States.

The top steel exporters to the U.S. are Canada, Mexico, Brazil, South Korea and Japan, with exports from Taiwan and Vietnam growing rapidly, according to the International Trade Administration.

Rising Product Prices

Higher production costs could be passed on to consumers, resulting in increased prices for products.

In response to these challenges, some companies are exploring strategies like restructuring supply chains and adjusting pricing models to mitigate the impact of tariffs. However, these adjustments may not fully offset the increased costs.

Tariff FAQs

In short, what is a tariff?

A tariff is a type of tax that is imposed by the government on imported goods. It’s intended to make foreign products more expensive.

Where does the money from tariffs go?

The US Customs and Border Protection (CBP) collects tariff revenue and puts it into the US Treasury.

Do tariffs affect all businesses?

Not all businesses will be affected. Companies that rely heavily on imports will see the most impact, especially in manufacturing, retail, and technology industries.

Are tariffs permanent?

No, tariffs can change based on trade agreements, government policies, and negotiations with other countries.

We’re Here to Help

Do you have more questions? Reach out to one of our NFI certified experts for help at 800.919.1904.

More Resources

Find out the potential risks of buying a fireplace from a seller that doesn’t charge sales tax.

Wondering if a gas burn ban law might prevent you from installing or enjoying a fireplace?

Discover how to receive tax credits for making energy efficient home upgrades.